What is Financial Independence, Retire Early (FIRE)?

Financial Independence, Retire Early — or FIRE for short — is a financial plan followed by a growing number of committed savers. By putting aside the majority of their annual income, hardcore FIRE fans reject the typical pathway of working into old age. Instead, they live a frugal lifestyle in earlier years so that they can have more freedom in later years. Some FIRE followers even retire in their 30s or 40s!

Need-to-knows

- FIRE stands for Financial Independence, Retire Early. There are various versions of the concept to encapsulate different lifestyles.

- This program is not for the faint-hearted! You may need to set aside 70% of your income for some years if you want to retire decades before you turn 65.

- As well as making financial cutbacks to maximise savings, you also need to consider ways to boost your income.

The original FIRE plan: how FIRE works

Financial Independence, Retire Early works on the basis that its advocates spend very little money during their employment years, in order to save a lump sum to facilitate their early retirement. For this to work, people need to save between 50% and 75% of their income. That's a LOT!

Vicki Robin and Joe Dominguez first coined the name in 'Your Money or Your Life', a financial guide published in the early 1990s.

The program requires followers to save until they reach an amount which is around 30 times their annual expenses (typically approximated at $1M). Once they reach this figure, they can take early retirement — provided they carefully regulate how much they withdraw during retirement, not exceeding 4% of the original sum in any year.

What's the point of Financial Independence, Retire Early?

The idea is to reach financial independence, allowing you to make choices about your life rather than being bound by debt. Once you reach financial independence, you are unlikely to become a big spender (unless you want to burn through your savings very quickly), but you do have the financial freedom to choose whether or not to work, as well as the type of work you do, and for how much of your time.

What versions of the FIRE plan exist?

Adaptations include lean FIRE (the strictest savings and most minimalist lifestyle); fat FIRE (a more comfortable lifestyle, but still making big savings); barista FIRE (incorporating casual or part-time work to supplement retirement); and coast fire (retirees who do not need to work at all).

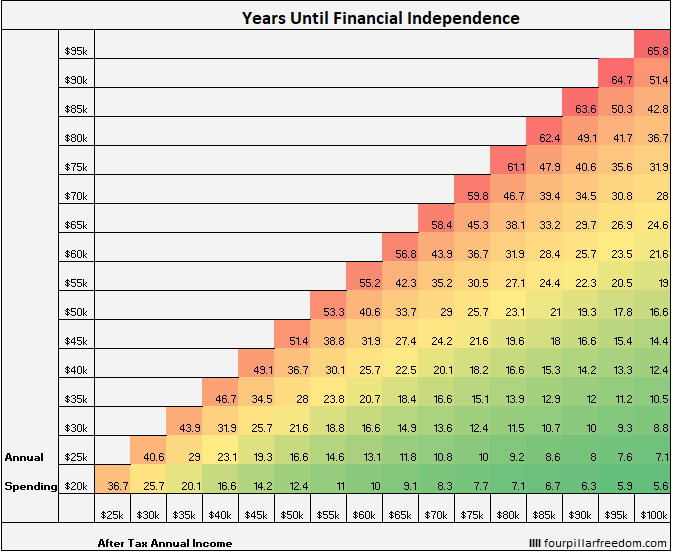

Early retirement chart

The chart below comes from Four Pillar Freedom. It demonstrates how many years it might take you to reach financial independence based on your current yearly income and spending. It assumes that any investments you make will receive 5% interest growth per year and that you'll be withdrawing 4% of your savings each year once you retire.

As an example, if you make $40,000 per year after tax and spend $30,000 per year on expenses, it will take you 31.1 years to reach a retirement level where you can safely withdraw 4% of your investment fund.

Are there any problems with Financial Independence, Retire Early?

Yes, there are quite a few issues with FIRE.

Significantly, the FIRE plan is not an option for everyone. If you're on a low income, it may already be challenging to meet your basic living costs, let alone make enormous savings on top of that. It's a feasible way of life for someone on a six-figure salary, but could be very tough on anything less.

You also need to have a certain personality type to follow the rigid and restrictive savings plan. FIRE might suite a meticulous person who enjoys planning and doesn't prize their annual vacation.

Finally, as with many financial decisions, there is an element of unpredictability. If markets plummet after retirement, living costs might increase while interest on savings could decrease. That lump sum might not take you as far as you had hoped. Or a person's personal circumstances could change: a flooded home, a new child, a kidney transplant... Unforeseen expenses can put pressure on a lifestyle which relies on tightly restricted spending.

Top tips for starting the FIRE plan

- Get out of debt first! There's no point saving while your debt grows bigger month on month (check out our compound interest calculator here to learn more).

- Set up some good savings and investments. Get that compound interest working in your favor! Try out our savings calculator to see what a difference this can make.

- Start earning extra. Overtime, a second job, raising your prices: whatever works!

- Cut down on monthly spending (coffees, TV subscriptions, clothes, etc.)

- Consult a professional financial advisor to ensure this is a safe plan for you to follow.

Savings goal calculator

If you want to play around with some numbers for how long it might take you to save a certain amount of money within a certain period of time, give the calculator below a try.