Featured articles

This section of The Calculator Site contains interesting articles about finance, currency as well as instructional 'how to' features on converting between units.

How to Calculate Square Footage - Step by Step

Whether you're shopping for carpet or planning a landscaping or home improvement project, square footage is a key metric to understand. So, let's go through the steps involved in calculating it. Further down, we'll also include a handy calculator to help you with your calculation...

How Long Would it Take to Walk Around the World?

Do you have a fully charged cell phone, some sturdy walking shoes and a really big bottle of water? Great. You'll be home in a mere matter of months, though exactly how long it takes to walk around the world will depend on a couple of factors...In which direction are you walking around the world?T...

How Much is a TRILLION?

A trillion is one million million (or one thousand billion) and has twelve zeroes: 1,000,000,000,000.If you owned a trillion dollars and spent $1,000,000 each day, it would take you just under 2,740 years to spend it all.It'...

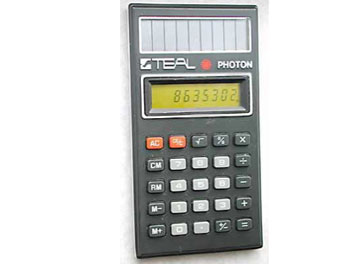

The History Of The Calculator

If you need an illustration of the accelerating speed of technological change, look no further than the electronic calculator, that modest little device that does the most complex sum instantly and that you hold in the palm of your hand. Or more likely don't anymore.....

Airline Baggage Weight - Why Does It Matter?

Article summary: Airline baggage restrictions might seem like a hassle, but they're pivotal for the smooth operation of modern air travel. These limits are important for staying within safe maximum take-off weights and ensuring efficient operation through ever-complex baggage handling systems...

Maximizing Your Investments With Compound Interest

In the realm of personal finance, few concepts wield as much power and promise as compound interest. Often hailed as the 'eighth wonder of the world' by investment gurus, its ability to exponentially grow wealth over time is unparalleled. Yet, despite its significance, compound interest remains a ne...

Strategic Budgeting and Forecasting with Financial Calculators for Small Businesses

In the dynamic world of small business, financial agility and foresight are not just virtues but necessities for survival and growth. Strategic budgeting and forecasting emerge as the twin pillars supporting this financial acumen. However, navigating these complex territories often poses a significa...

Decoding Your Paycheck: Understanding Salary and Tax Deductions with Online Calculators

Navigating paycheck details and tax deductions can often feel like a daunting task. For many, a paycheck is a complex document, filled with various numbers and financial jargon. Understanding the breakdown of your earnings is not just about knowing how much you're bringing home; it's also crucial fo...

How Many Miles is 10,000 Steps?

For an individual of average height, 10,000 steps equate to around 4 ½ miles of walking, or 6 miles of running. Such a person has an average stride length of between 2.1 to 2.5 feet, meaning they take approximately 2,250 steps to walk a mile.To gain a more accurate me...

What is a Dash, Pinch, Smidgen and Nip?

A dash of this, a pinch of that - they're terms we've all seen in recipes. What exactly do they mean, though?Old-fashioned measurements explainedThese measurements don't have precise, fixed definitions, but there is a general consensus amongst baking experts about what they mean...

Other featured articles

- How to Write Feet and Inches

- Why I've Chosen Ezoic as a Partner

- Saving Tips for Young People

- How Much Does a Cubic Yard Weigh?

- How Much Does a Gallon of Water Weigh?

- What is the Difference Between Nominal, Effective and APR Interest Rates?

- How Much is a Ton?

- What is Financial Independence, Retire Early (FIRE)?

- How Many Cubic Feet is my Refrigerator?

- How to Calculate Net Income (With Examples)

- 6 Alternatives to Body Mass Index (BMI)

- Density Formula - How To Calculate Density

- Weights and Measures - a Poem

- How to Calculate Percentages

- How Many Meters Are in a Mile?

- How Big Is A Hectare?

- PEMDAS Explained - How Does PEMDAS Work?

- How Big is an Acre? Explained

- US Gallons And Imperial Gallons - Why Are They Different?

- How Many Cups in One Pound of Flour?

- How Many Cups in One Pound of Sugar?

- BMI Formula - How To Use The BMI Formula

- How Many Grams Of Sugar Are In a Teaspoon?

- How Many Cubic Feet Are in a Yard?

- Profit Margin Formula - Explained

- BODMAS Explained - Order Of Mathematical Operations

- Fun and Interesting Math Facts

- How to Convert Kilometers to Miles and Miles to Kilometers

- How Many Beers Are in a Keg?

- How To Measure Your Waist

- How To Measure Your Hips

- How Many Feet Are in a Mile?

- BMR Formula (Basal Metabolic Rate)

- The Misrepresentation Of Sugar Intake In The Media

- LED Light Bulbs - Why Should You Switch?

- Balloon Payments: Definition and Benefits

- Meters And Metres - What's With The Spelling?

- How Many Feet Are In a Meter/Metre?

- Cooking Weights And Measures Guide

- How Many Days Since...?

- How Many Weeks Are In a Year?

- Tablespoons and Cup Sizes Around The World

- How To Add, Subtract, Multiply And Divide Fractions

- Should You Pay In Local Currency Or Home Currency When Abroad?

- Is a Kilobyte 1000 Or 1024 Bytes?

- The Gambler's Fallacy - Explained

- How to Save Money as a Student

- How long is a light-year?

- How fast is the speed of light?

- The weird and wonderful world of units of measurement

- How to Measure Things Without a Ruler

- How to Convert mg to ml (Milligrams to Milliliters)

- What Is Body Mass Index? How Is BMI Calculated?

- A brief history of the metric measurement system

- A brief history of loans

- Armed forces by numbers

- 6 clever time keeping instruments invented by man

- Calculating chance - the rules of probability

- How to convert International units (IU) to mcg or mg

- What is the Difference Between Speed and Velocity?

- What Is The Difference Between Mass And Weight?

- How to convert metric to imperial - and back again

- What is APR? How Does APR Differ From Standard Interest Rates?

- How Usain Bolt Compares To The Fastest Animals On Earth

If you have any finance articles or interesting articles on units that you would like to submit for consideration for future publishing, please submit them via the form on this page.