Decoding Your Paycheck: Understanding Salary and Tax Deductions with Online Calculators

Navigating paycheck details and tax deductions can often feel like a daunting task. For many, a paycheck is a complex document, filled with various numbers and financial jargon. Understanding the breakdown of your earnings is not just about knowing how much you're bringing home; it's also crucial for effective financial planning and fulfilling your tax obligations.

This is where the power of online calculators comes into play, transforming a seemingly intricate task into a manageable one. This article aims to demystify the components of your paycheck and explain how utilizing online calculators can simplify the process, ensuring you're well-informed about your salary and taxes.

Understanding your paycheck: The basics

At its core, a paycheck comprises several key elements. The gross salary is your total earnings before any deductions. This amount then undergoes various subtractions, resulting in your net salary - the actual amount you take home. Common deductions include federal and state taxes, contributions to Social Security and Medicare, and possibly others depending on your employer's benefit programs.

An often-overlooked component is the Year-to-Date (YTD) totals. These figures represent the cumulative amount you've earned and the deductions made over the current year. Regularly reviewing these details not only helps in understanding your current financial standing but also aids in planning for the fiscal year, especially when it comes to tax obligations and potential refunds.

Federal and state tax deductions explained

The deductions for federal and state taxes are perhaps the most complex parts of your paycheck. These are influenced by several factors, including your filing status (single, married, etc.), the number of exemptions or allowances you claim, and your income level which determines your tax bracket.

Federal tax is calculated based on the IRS tax brackets, which are progressive – meaning the rate increases as your income does. State tax calculations, on the other hand, vary significantly depending on the state's tax laws. Some states have a flat tax rate, while others have a progressive system like federal taxes.

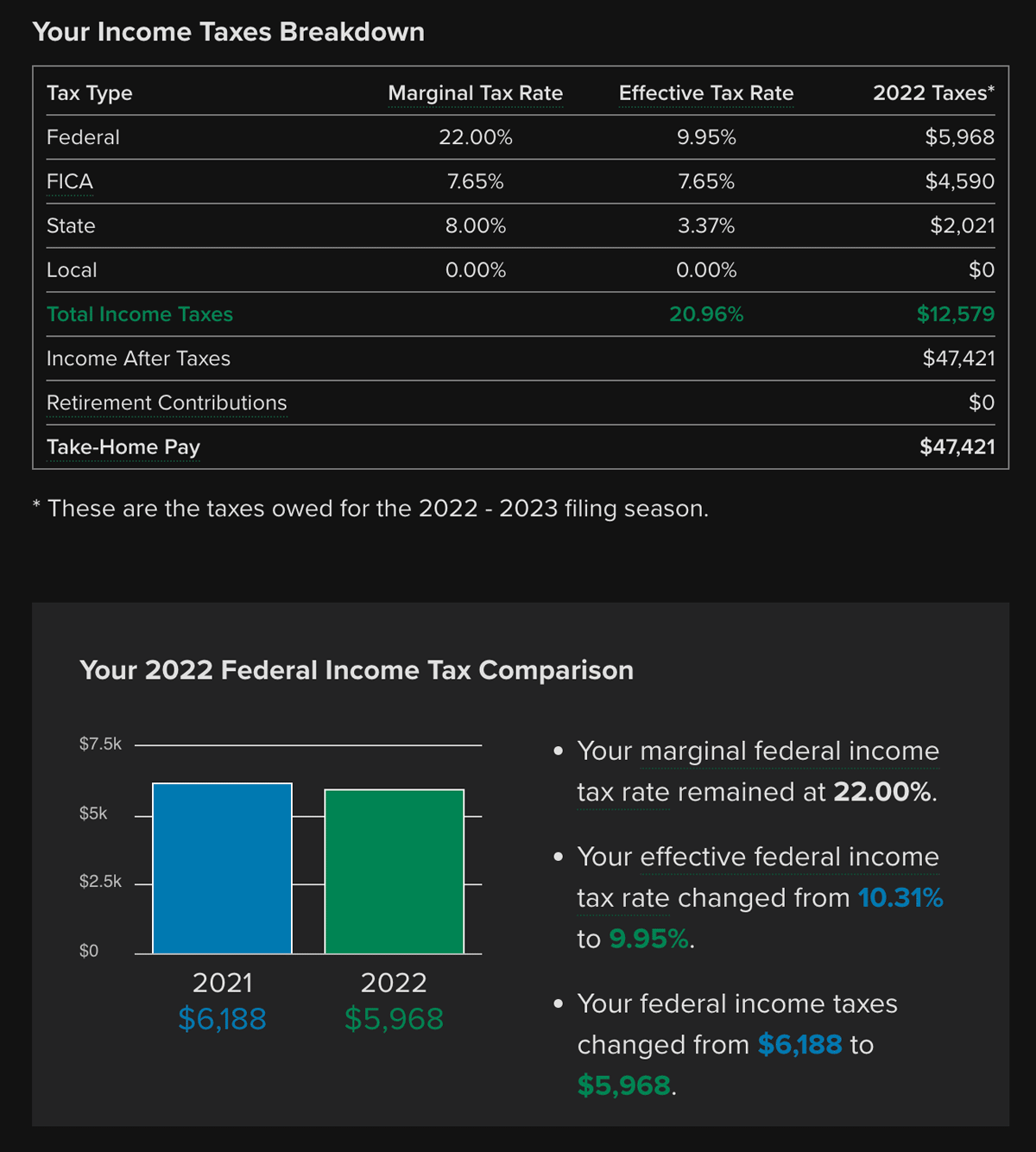

Online tax calculators come in handy here, such as the one provided by SmartAsset. By inputting your salary, filing status, and other relevant details, these tools can estimate your tax deductions with reasonable accuracy. For instance, if you input a gross salary of $60,000 per year with a single filing status, the calculator can break down how much will be deducted for federal and state taxes, giving you a clearer picture of your net income.

Social security and medicare contributions

Social Security and Medicare are foundational components of the U.S. social safety net, funded by deductions from every paycheck. For Social Security, the current deduction rate stands at 6.2% of your gross income, up to a certain income limit. Medicare, meanwhile, is deducted at 1.45%, with no income ceiling. For high earners, an additional Medicare tax may apply. 1

Understanding these contributions is crucial not just for paycheck clarity but also for long-term financial planning. Social Security contributions, for instance, directly impact your benefits in retirement. Online calculators can help you estimate the amount deducted for these programs and, in the case of Social Security, project your future benefits based on your current earnings.

Using online salary calculators for better financial planning

Online salary calculators are more than just tools for estimating net pay; they are instruments for holistic financial planning. By inputting various details such as your gross pay, tax filing status, and deductions, these calculators provide a clear picture of your take-home salary.

For instance, if you're planning to take on additional work or considering a job offer with a different salary, these calculators can help you understand how these changes affect your net income. They can also be pivotal in budgeting, helping you align your spending and savings strategies with your actual take-home pay.

Additional considerations: Bonuses, overtime, and benefits

Paychecks often include more than just your regular salary. Bonuses, overtime pay, and benefits like health insurance or retirement plan contributions also play significant roles. Bonuses and overtime are subject to taxes, sometimes at different rates than regular income. Benefits, on the other hand, might be pre-tax deductions, effectively reducing your taxable income.

Online calculators can help you understand how these additional factors impact your paycheck. By incorporating your total earnings, including bonuses and overtime, along with deductions for benefits, you can get a more accurate picture of your financial situation.

In addition to standard tax deductions, many paychecks include deductions for retirement plans like 401(k)s or health plans such as HSA (Health Savings Account) contributions. These deductions are critical for long-term financial wellness and often offer tax benefits.

- Retirement Plan Contributions: Contributions to retirement plans like a 401(k) are typically made pre-tax, meaning they are deducted from your gross income before taxes are applied. This not only lowers your taxable income but also allows your savings to grow tax deferred. Using an online calculator, you can determine how increasing your 401(k) contributions affects your paycheck and, importantly, your retirement savings over time.

- Health Plan Deductions: Health plan contributions, including HSAs or FSAs (Flexible Spending Accounts), are also often made pre-tax. These plans can reduce your taxable income and provide a financial cushion for medical expenses. Online calculators can help you understand the impact of these deductions on your take-home pay and assist in deciding how much to contribute based on your healthcare needs and financial goals.

By carefully managing these deductions with the aid of online calculators, you can optimize your paycheck for both immediate financial stability and future security.

Conclusion

In today's world, where financial literacy is as crucial as ever, understanding the nuances of your paycheck is not just a necessity but a stepping stone towards effective financial management. Online calculators offer an accessible, user-friendly means to unravel the complexities of salary and tax deductions.

We encourage you to actively use these calculators as part of your routine financial review. By doing so, you'll gain a clearer understanding of your financial standing, empower yourself to make informed decisions, and take proactive steps in managing your finances. Stay informed, stay prepared, and let these tools guide you to a more secure financial future.

References: